There is something I’ve been meaning to do for a long time, but I’ve been putting it off for years. Every time I see my husband sitting at his computer paying the bills, a voice goes off in my head: “Get it done now, get it done now.”

I have to confess, I don’t know all of our passwords to our bank accounts and other important accounts online. I wouldn’t be able to access any of these accounts if I needed to. Heck, I don’t even know the password to unlock my husband’s cell phone. Yet I know it’s important to know this information. God forbid something would happen to my husband. What would I do?

I should know better. My dad died of a heart attack when he was 48-years-old and he didn’t leave a will. My family had to hire a lawyer to straighten things out with his possessions: bank accounts, businesses, house and even his car. And while I don’t worry that my husband or I will pass away anytime soon, you just never know when something unexpected can happen.

Read Related: Why Women Must Be Financially Savvy

CHANEL REYNOLDS LEARNED THE HARD WAY

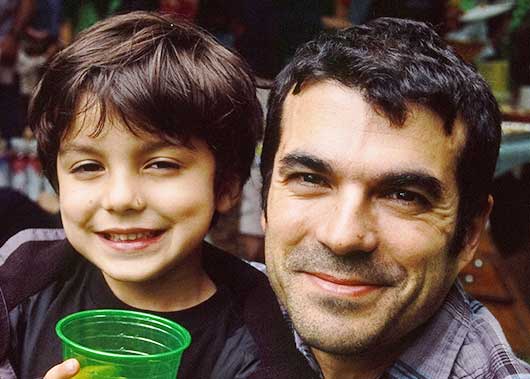

When I heard about Chanel Reynolds, I thought “I could be her.” Her life changed tragically in July 2009. That’s when her husband, José Hernando was hit by a van during a bike ride in the Seattle area. Reynolds and her son were at a friend’s barbecue when she got a call that her husband had been in a horrible accident. By the time she got to the hospital, he was on life support.

Reynolds remembers being in the hospital room surrounded by doctors, hearing the grim prognosis. “The severity of situation started to sink in,” she recalls. Suddenly questions started popping up in her head. “I was also overwhelmed with questions like How much life insurance do we have? Do we have long term or short term disability? A lot was going through my mind.”

A week later, she made the decision to take her husband off life support, because doctors told her José would not recover from his brain and spine injuries. Reynolds had no time to grieve. She knew she had to make some important decisions.

Though she and her husband had dealt with their personal finances together, there was much she still did not know. “His insurance was through his work, and we never talked about what he signed up for. I didn’t have passwords to his phone or know all his 401K information.”

The couple had drafted their wills and living wills. But they had not signed the documents and instead had turned them into the family lawyer. Chanel admits she was overwhelmed: “It took so much time and energy trying to contact all these different places to say ‘my husband died and I have to figure out how I can have access to his information.’”

FROM TRAGEDY TO A NEW BEGINNING

While Chanel Reynolds sat at her husband’s bedside, grieving and confused, she kept thinking, “Get your sh*t together.” After he passed away, she needed to gain control of her husband’s assets and passwords to all his accounts. It took a lot of time and work, and it was stress she didn’t need during an already horrible period of her life. She spent $2,000 in legal fees to navigate through probate court—that’s where a person’s assets end up if there is no will. “It’s such a hard emotional time and then if you deal with additional stress about money and house, it’s unfair and unnecessary,” says Reynolds.

Reynolds started GetYourShitTogether.org to help others avoid going through the emotional roller coaster she endured while trying to get control of her husband’s personal accounts. Her website offers simple financial tips, and checklists for online account passwords and handling insurance. She also offers free forms to download to draft a will, living will and power of attorney. She believes it’s never too early to plan for your or a loved one’s death. “Death is one thing we all have in common. Sooner or later, we’re all going to die.”

Chanel Reynolds is now 43, and lives with her son and stepdaughter in the Seattle area. She believes she is empowering families with her website. “Planning for death can really help you pay more attention to the life you have now.”