Paying off College debt seems like an impossibility, but there is still hope. President Obama has announced the “Pay As You Earn” plan to make student loans more affordable for students. The plan will cap repayments for student federal loans at 10 percent of a graduate’s discretionary income. It will also reduce interest and allow graduates to consolidate multiple loans. Students who qualify will be forgiven their loans after 20 years. The current law allows borrowers to limit their loan payments to 15 percent of their discretionary income and forgives all remaining debt after 25 years.

According to “Pay As You Earn,” starting in January 2012, students will be able to consolidate their federal loans under one monthly payment and get a 0.5% reduction in interest rates.

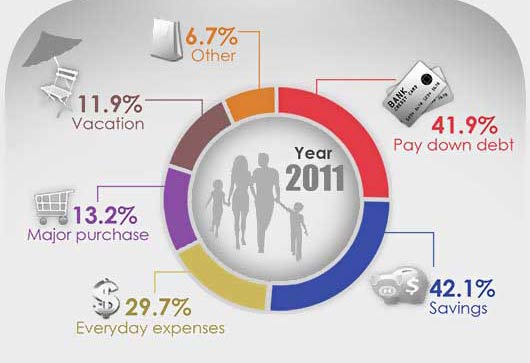

While the new plan may help make loan repayment more affordable, the plan does not address the underlying problems of the rising costs of education. According to The College Board, college and tuition costs across the US have increased about 130%, over the past two decades alone. Ana Galan, founder of The Nola Tree, an organization that encourages teenagers to volunteer in rebuilding projects in New Orleans and mother of two children in college, says: “Increases in college tuition means we are tightening our budget, reducing our vacation, cutting any unnecessary expenses, and working overtime to help our children pay for a college education.”

HOW COLLEGE DEBT AFFECTS YOUR CHILD’S FUTURE

Graduating with debt is a reality that may be unavoidable for some students, but when it’s not managed well, it can contribute to young graduates having a poor credit history that can affect their ability to secure a mortgage or a car loan later on in life. That’s why it’s critical for you and your children to carefully explore all federal loans, grants, work-study programs and scholarships available before you sign up for a private loan.

WHAT CAN STUDENTS DO?

There are things you can do to help reduce overall college debt. For example, opening a 529 savings account allows you to save money for college tax-free. Johanna Torres, publisher of Miblogazine www.miblogazine.com a style and fashion online magazine, and mother of three, had the foresight of saving from the time her kids were born. “It all happens so fast, that it’s definitely better to start early so that the process won’t be so difficult and painful. A 529 plan does just that, helps set aside a little bit of money at a time so that when the day finally gets here, I can breathe a sigh of relief knowing money alone shouldn’t be what keeps my kids from going to the colleges of their choices.” In addition to seeking financial aid and the savings the Torres family has accumulated, Johanna says she’s confident that all three of her children “will find the best school to fit their needs and our pockets.”

Students should also apply for FAFSA close to January 1st of every year for which they need financial aid. This helps ensure a better chance of qualifying for government grants because they are distributed on a first come first served basis. FAFSA will also let you know if your child qualifies for government subsidized and/or unsubsidized loans. Not only are government loans now protected under the new payment plan, but the interest rates are much lower than the rates on private loans.

Keep in mind that whenever possible private loans and credit cards should be your last option for financing college. Private loans have higher interest rates and strict repayment policies. Some require that students begin repaying the debt at once rather than after graduation. And the high interest rate of credit cards can make your payments balloon to an insurmountable amount.

Finally, making sure that students study careers that are in high demand is also an important way to reduce the overall problem of college debt. When students graduate with competitive skills, they are less likely to suffer extended periods of unemployment. This makes it easier for students to start their working life on the right foot and to leverage the higher salaries they will command, thanks to their college degrees, to pay their student loans.