Many parents can’t figure how to afford to keep their kid in college. Given the high cost of a college education these days, a hefty college tuition bill might be a tough pill to swallow during lean economic times. As is the case with many Latino families, you can work hard for years, yet still be unable to save enough to pay for your child’s college education. How can parents afford to keep your child in school and a roof over your family’s head?

First, don’t give up on the goal of providing your kids with a college education. A college degree should not be an option that you evaluate against other material investments, like a car. According to the US Department of Labor, the unemployment rate of college graduates is twice as low (4.4%) as those with a high school diploma (8.8%), and three times lower than high school dropouts (13.2%). So the message of higher learning is clear. Still, what can you do to prepare and support your children through college when your household is financially stressed?

1. Open a 529. If you haven’t already opened a 529 college savings account, it’s not too late to start. This tax-advantaged savings plan, available in most states, enables you to invest for college free of federal and sometimes state income taxes. (Check CollegeSavings.org to find your state’s plan options.) Once a 529 account is set up, you can give this account number to relatives, friends and any willing donor to deposit money directly into your child’s account. (What an awesome alternative to birthday and Christmas gifts!) These funds can then be used to pay for tuition, room and board, books, and other qualified college expenses.

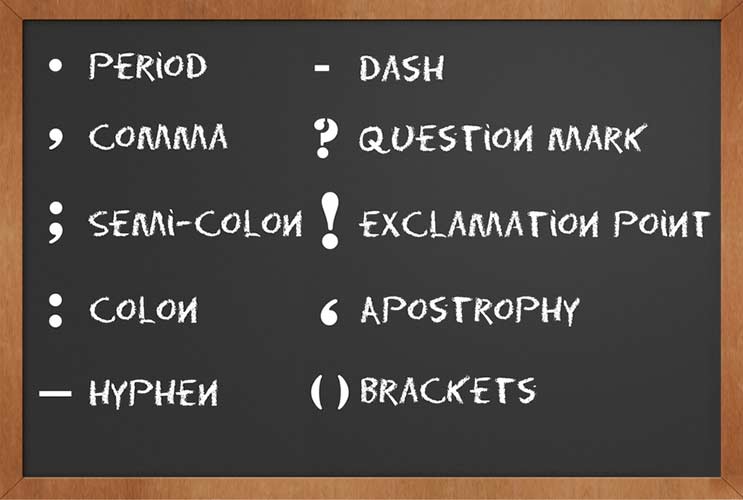

2. Know the financial aid lingo. Become well versed in all sources of financial aid: scholarships, fellowships, work-study, Pell grants, government subsidized loans and private loans. Visit Latinos in College and take a look at Paying for Schools to find helpful information. The more you know, the better you can support your children in the search for financial aid.

3. Identify financial aid gurus and mentors. Encourage your college kids to build a network of people who can guide them in the process of how financial aid works as well as navigating the academic policies and even campus environment. This support group should not just include the college financial aid staff and academic advisors, but also upper classmen, alumni associations and well-versed professionals who can provide insights on available sources of funding.

4. Create a fundraising portfolio. Help your children build a fundraising portfolio that includes their community involvement projects and their academic record to present to potential sponsors. You can also conduct year-round fundraisers with your kids via an application like Chipin, which raises funds from friends, acquaintances and family members who can share the application on their social media pages and extend the pool of people who donate college money.

5. Consider community college first. Of course, the goal is for your child to earn a degree from an accredited four-year university. However, there is nothing wrong with starting college at a local community college. Here’s the key: You must encourage your kids to study hard and consult with the school’s Transference office early on and regularly to make sure they take the required courses in order to transfer to the four-year college of their choice. Again, having a bachelor’s degree is what contributes to a much higher income and lower unemployment rate among young people.

6. Emphasize good grades. Whether your kid is at community college or a four-year university, parents need to encourage their college-aged kids to do well academically so they have wider access to financial aid and merit scholarships. One “D” can drop a grade point average dramatically, so stay abreast of your kid’s academic progress load throughout the semester. If your college student feels overloaded or overwhelmed, a dropped class might be a better solution than a lower GPA.

Lastly, it is critical for you to acknowledge that attending college is your kid’s full-time job. As I recently told NPR’s Michel Martin on her radio show Tell Me More, college students still commute from home, and have strong family ties and responsibilities. But regardless of your household situation, it’s important that parents limit the demands on their college kid as far as babysitting younger siblings, taking care of older relatives, or contributing financially to the household. Teenagers may be able to hold a part-time job while in high school or college, but a full workload makes it almost impossible for college students to focus and do well academically. The bottom line is your college-aged kids will be much more capable of helping your family with a degree in a few short years than without one now.